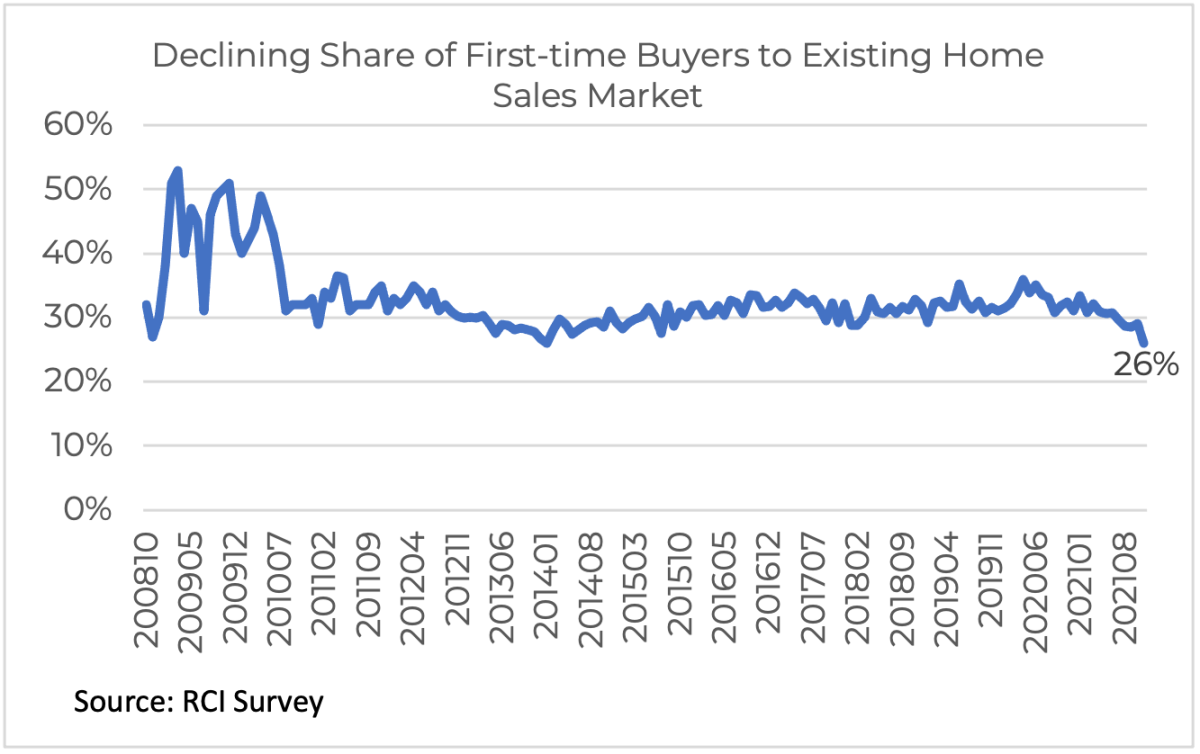

Many first-time buyers continue to struggle to move into homeownership amid sustained price growth and competition from all-cash buyers. The share of first-time buyers fell to 26% in November, according to the November REALTORS® Confidence Index Survey, a survey of REALTOR® transactions. This is the lowest level since January 2014 (also 26%) and since NAR started tracking the share of first-time buyers on a monthly basis in October 2008. In 2020, first-time buyers made up 33% of existing home sale buyers, according to the RCI Survey. NAR’s 2021 Profile of Home Buyers and Sellers also reported an annual first-time buyer share of 34% among primary residence buyers only during July 2020-June 2021.

There are a variety of factors that influence the decision of first-time buyers to make a home purchase and to be successful in their offer. However, affordability and ability to compete with other buyers are arguably important factors.

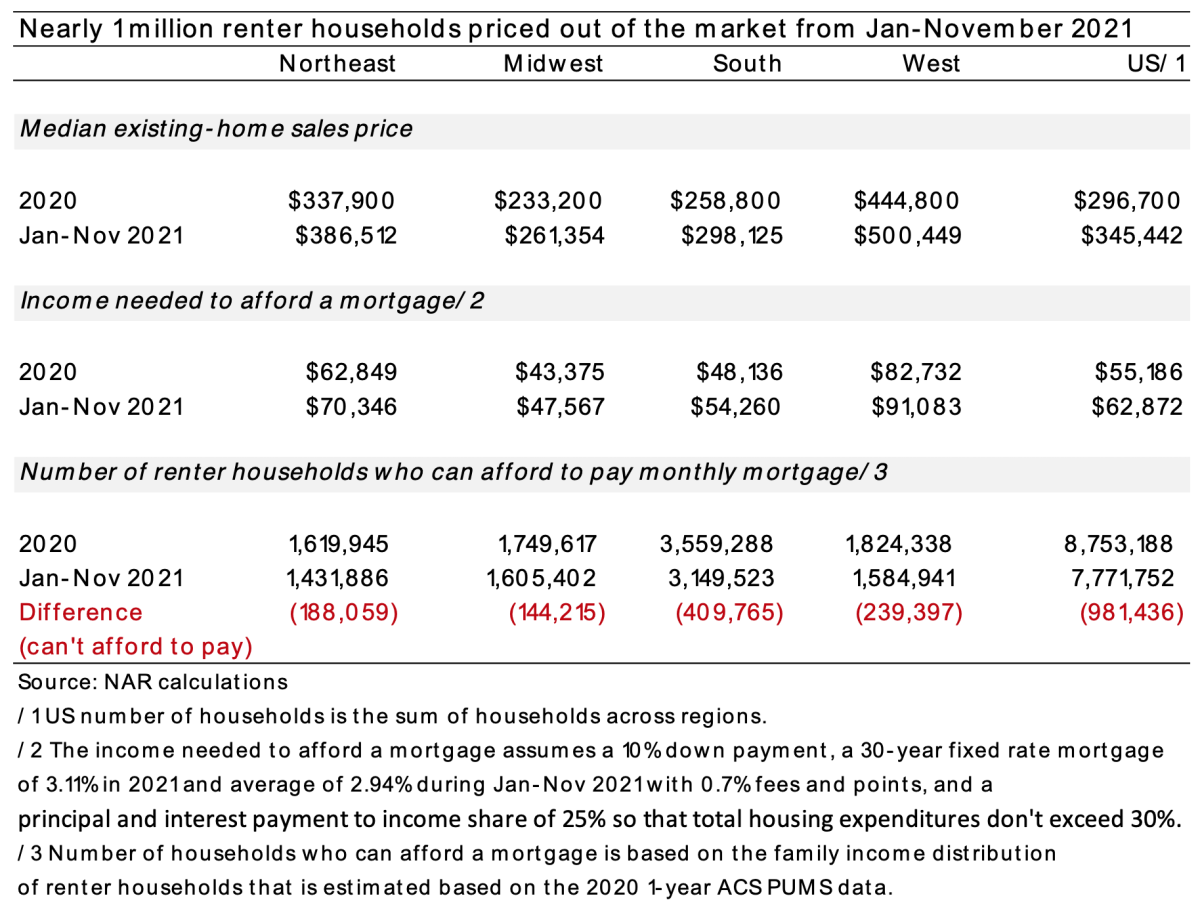

Nearly 1 million renter households priced out due to rising prices

Under historically low mortgage rates and supply bottlenecks, demand has outpaced the supply of homes available on the market, resulting in double-digit price appreciation. NAR’s latest November existing home sales data showed an uptick in the median existing home sales price to $353,900, a 13.9% year-over-year increase.

How the distribution of prices has shifted upwards is indicated by the share of properties priced at up to $250,000. In 2012, properties priced at $250,000 or below made up 68% of the market. As of 2021, that share has been cut in half to just 30.8%. Properties priced at over $1 million that made up less than 2% of the market in 2012 now account for 6%, or triple the share.

This rise in prices is pricing out potential homebuyers. The table below shows that nearly 1 million renter households got priced out of the market due to the price increase in 2021. During January-November 2021, the median existing-home sales price averaged $345,442, a 16.4% year-over-year increase from the median sales price of $296,700 in 2020. At this price, the income a household needs to pay the mortgage affordably such that the monthly mortgage payment and interest payment don’t exceed 25% of income rose to $62,872, up from $55,186. Based on the income distribution of renter households in 2020, I estimated that the number of renter households who can pay the mortgage affordably declines from 8.75 million to 7.71 million. This means 980,436 renter households got priced out of the market, (assuming they can make a 10% down payment).

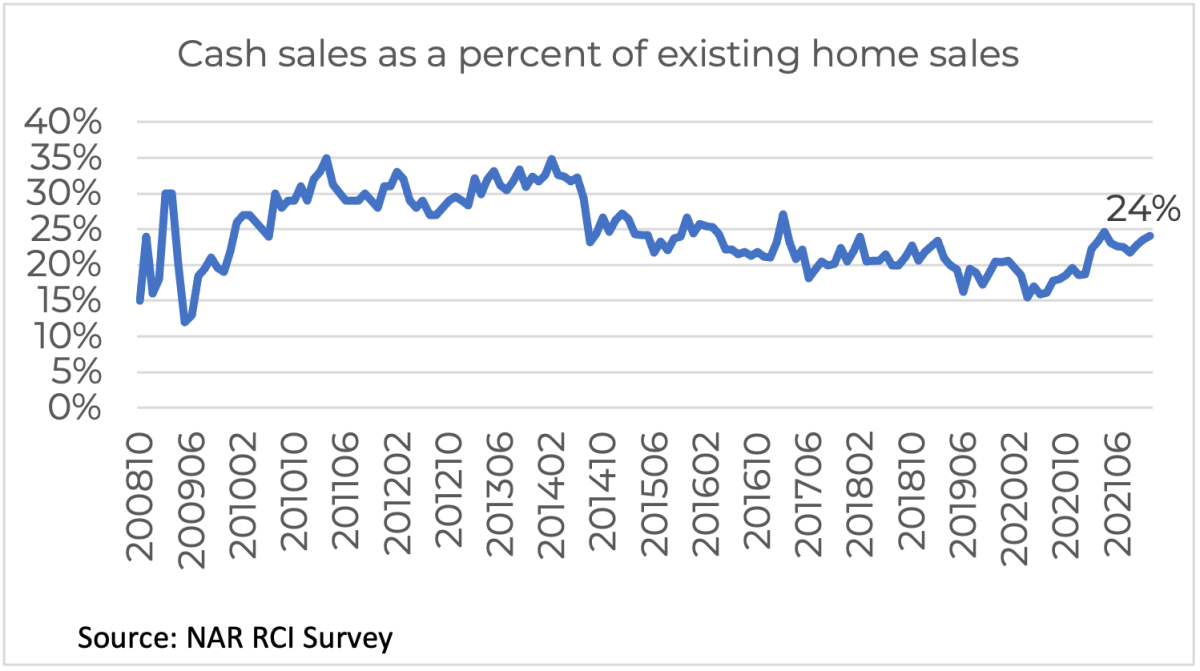

Cash Buyer Share Remains Elevated at 24% But FinTech Companies Are Providing Cash Back for Buyers

The share of cash buyers of sales that closed in November 2021 remained elevated at 24%. Sellers tend to prefer cash buyers because buyer financing is assured, unlike in the case of mortgage financing which has the risk of the contract not closing if the property appraises for a lower value and the buyer cannot come up with the difference or the seller is not willing to bring down the prices.

First-time buyers tend to obtain a mortgage rather than make an all-cash purchase. During January-November 2021, only 7% of first-time buyers made an all cash purchase compared to 30% of all non-first-time buyers.

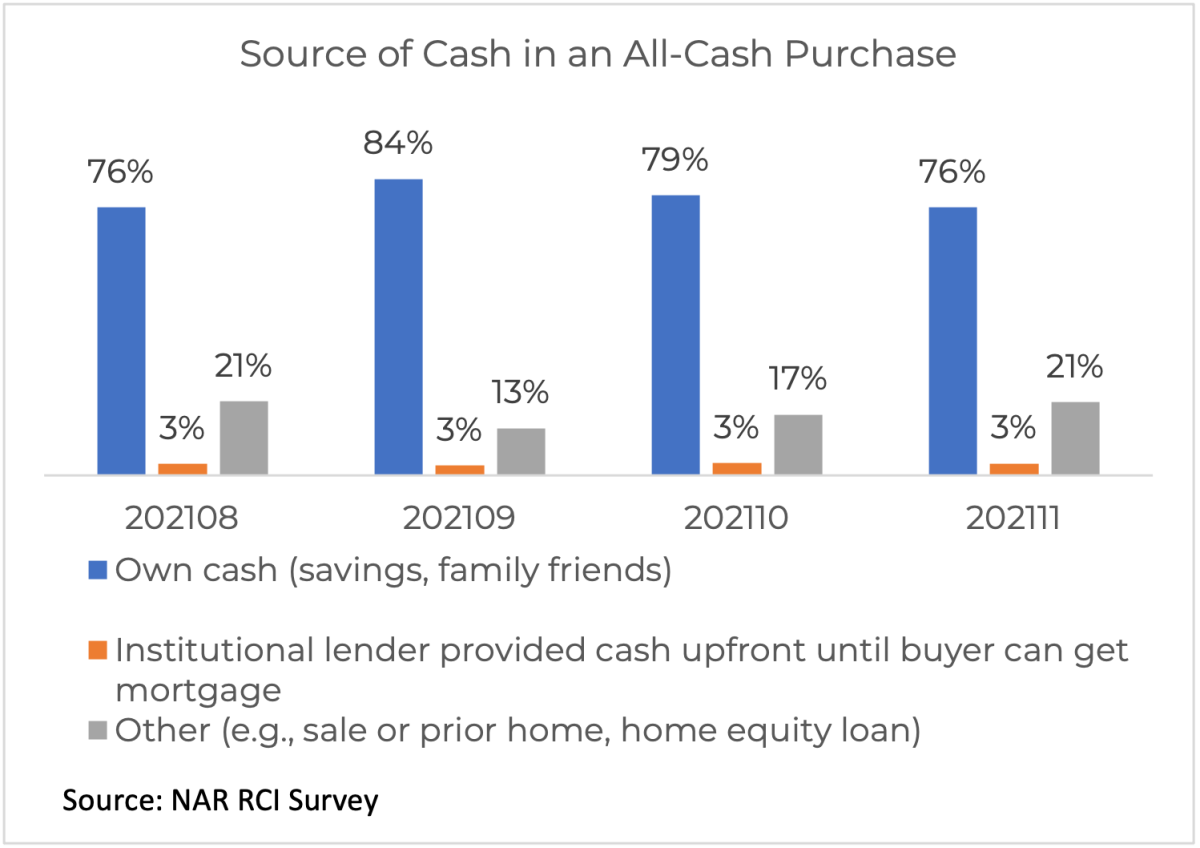

However, there are now fin-tech companies that have emerged that provide the buyers with a cash-back up if they can’t obtain a mortgage at the time of closing or also the cash if the appraisal value falls below the contract price. These fin-tech companies essentially provide bridge financing for the buyer so they have financing at closing time, thus reducing the risk to the seller that the deal will fall through. According to NAR’s RCI Survey, 3% of the source of cash in an all-cash purchase came from institutional lenders who provided the cash. About three-quarters of all-cash buyers use their savings or money pooled from family/friends and about a fifth use cash from other sources, mainly the sale of a home or a home equity loan.

For example, OpenDoor provides the buyer with cash if the buyer can’t obtain financing at the time of closing but they do not cover the difference between the appraisal and the contract price (so the buyer can waive the financing contingency). OpenDoor charges 0.02% per day starting after 120 days from the day Open Door provided the cash at closing (annualized rate of 7.5%). Ribbon, which operates in a few states (Georgia, North Carolina, South Carolina, Texas, Tennessee) provides cash if the buyer fails to obtain a loan at closing time as well as the difference in the appraised value and the contract price. It charges a fee of 1% and an additional 2.75% of the home value if the buyer can’t close with their own financing.

An analysis of the cost to buyers of cash-backed offers shows that the cost of obtaining a cash-backed offer or cash offers is not much higher than the 3.7% to 4.4% average percent above the list price that buyers have already been offering to sweeten their offer. Moreover, cash-backed or cash offers give assurance to the seller that there is a ready institutional buyer who will purchase the home should the buyer not be able to secure mortgage financing.

Outlook for First-time Buyers in 2022: Slower Price Appreciation With Mortgage Rate at Below 4%

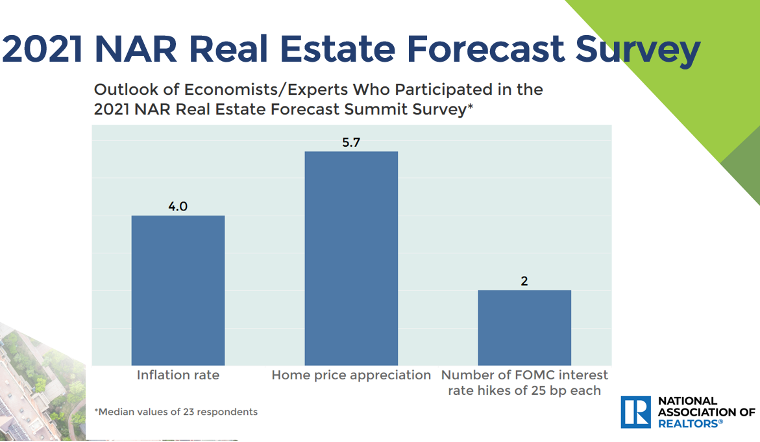

First-time buyers and all buyers will face a less frenzied market in 2022 with home prices rising more in line with wage growth. NAR forecasts home prices to increase at less than 5% in 2022 (2.8% for existing home sales and 4.4% for new home sales). A panel of economists, industry leaders and policy makers who participated in NAR’s Real Estate Forecast Summit expect home prices to increase by 5.7% .

While mortgage rates are expected to increase as the Federal Reserve reins in inflation back towards 2%, the 30-year fixed mortgage rate is expected to remain low at 3.7% by year-end, a level that is below the 4% rate prior to the pandemic.

Moreover, mortgage rates are likely to increase further in 2022. So homebuyers who are able to purchase a home in 2022 will be able to lock in at a lower mortgage rate.