By metro area

Based on the headlines, home prices outpace wage growth. Indeed, in the last six years home prices increased 47 percent while wages rose 16 percent. What do these percentage changes actually mean for a typical homebuyer? How much did the typical salary increase in dollars? How much more do buyers need to pay for their monthly payment because of the price increase?

NAR calculated the monthly earnings for a typical employee in both 2018 and 2012. Respectively, using the median home prices in 2018 and 2012, we also computed the monthly payment for a typical home for both years[1]. Then, we compared the change of the average monthly wages in dollars with the change of the monthly payment in the last 6 years.

Nationwide, the monthly earnings of a typical employee rose by $530 to $3,784 in the fourth quarter of 2018 from $3,256 six years earlier. In the meantime, the monthly payment increased by $354 to $1,114 in 2018 from $760 in 2012. Thus, although home prices increased nearly three times more than wages (in percentage points), homebuyers needed to spend less than their salary increase for the higher mortgage payment. Noticeably, homebuyers needed to spend nearly two thirds of their salary increase (above the 30% rule) for the higher mortgage payment[2].

Since all real estate is local, we calculated how much both the monthly wage and mortgage payment changed during 2012 and 2018 for the 100 largest metro areas.

In the last six years, the Seattle, WA and San Francisco, CA metro areas experienced the highest gains in wages. In both metro areas, the average monthly salary increased by $1,150 between 2012 and 2018. In the Seattle, WA metro area, the average monthly salary increased to $5,632 in the last quarter of 2018 from $4,479 six years earlier. However, in some metro areas, wages dropped. In the Tucson, AZ metro area, the average monthly earnings declined by $189. Similarly, in the Palm Bay, FL metro area the average monthly wages dropped by $172. Overall, the average monthly wages increased by $433 in the 100 largest metro areas.

In the meantime, home prices increased in all of the 100 largest metro areas except for the Bridgeport, CT metro area. As a result, current homebuyers need to pay a higher monthly mortgage payment for the same home compared to 2012. Among the 100 largest metro areas, San Jose, CA and San Francisco, CA metro areas experienced the highest increase in the monthly mortgage payment because of price appreciation. Specifically, in the San Jose, CA metro area, current homebuyers need to pay $2,428 per month more than in 2012 for the same home. However, overall, the monthly mortgage payment increased by $340 on average in the 100 largest metro areas.

Comparing the amount of the wage increase with the higher monthly mortgage payment, in 70 percent of the 100 largest metro areas, wages in dollars increased more than the mortgage payment. Moreover, in most of these metro areas, the increase of the mortgage payment accounted for less than 30 percent of the wage increase. For instance, in the Chicago, IL metro area the average monthly wage increased by $572 while the monthly mortgage payment rose by $326. Another example is the Dallas, TX metro area. In this area, homebuyers in 2018 earned $558 more every month than homebuyers in 2012 while the monthly mortgage payment increased $420 since 2012 because of the price appreciation.

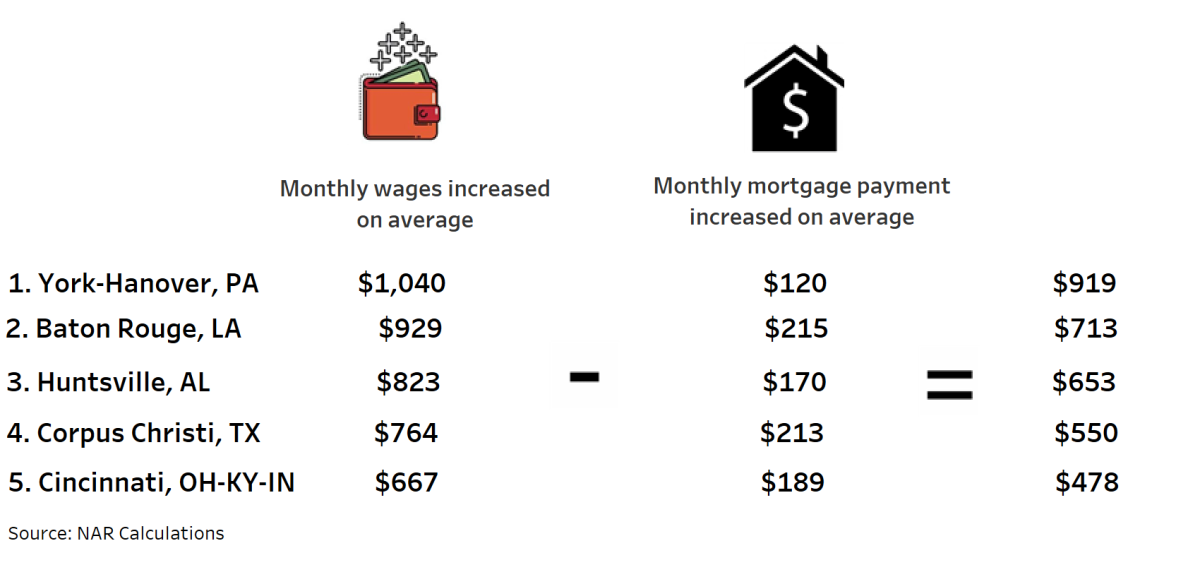

See below the top 5 metro areas with the highest monthly income gains compared to the extra housing cost:

Nevertheless, the extra monthly housing cost exceeds the income gains in 30 percent of the 100 largest metro areas. For instance, in the San Jose, CA metro area, homebuyers in 2018 earned $549 more every month compared to the homebuyers in 2012. However, the monthly mortgage payment increased $2,428 since 2012 because of the price appreciation. This means that homebuyers will need to attribute a higher percentage of their monthly earnings to housing cost since their income gains are not enough to cover the extra housing cost.

Here are the top 5 metro areas where the extra housing cost exceeds income gains:

See below how much both the monthly wage and mortgage payment changed during 2012 and 2018 for each of the 100 largest metro areas.

[1] Assuming the same mortgage rate at 4% for a 30-year fixed rate mortgage.

[2] Based on the rule of thumb, 30% of the gross income should be spent for housing.