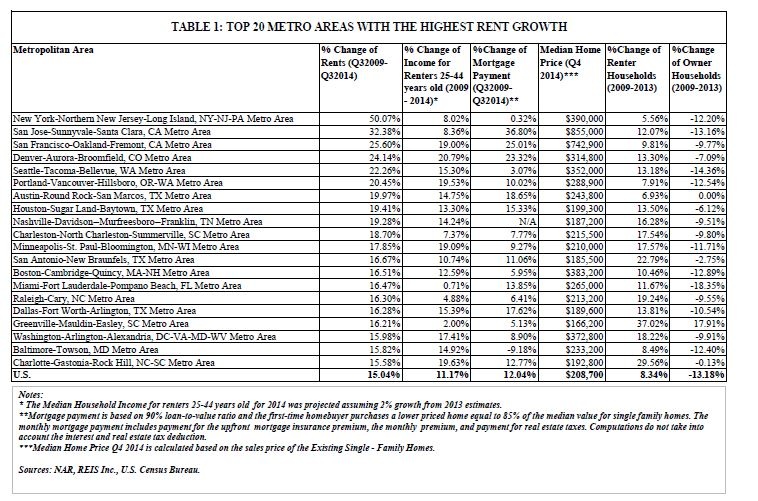

The gap between rental costs and household income is widening to unsustainable levels in many parts of the country, and the situation could worsen unless new home construction meaningfully rises according to new research by the National Association of Realtors®. In the past five years, a typical rent rose 15% while the income of renters grew by only 11%.

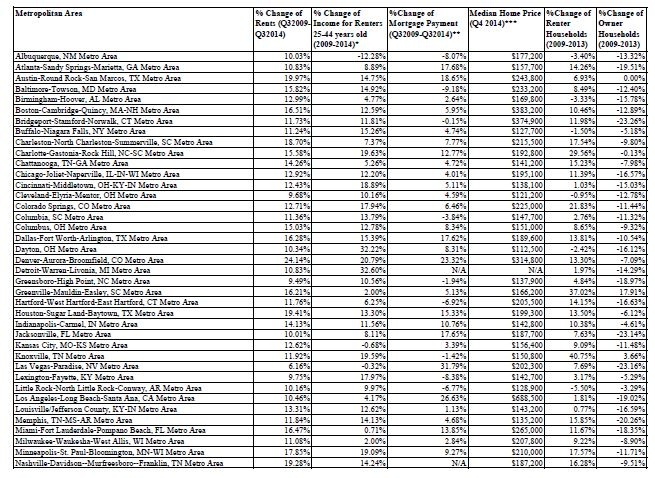

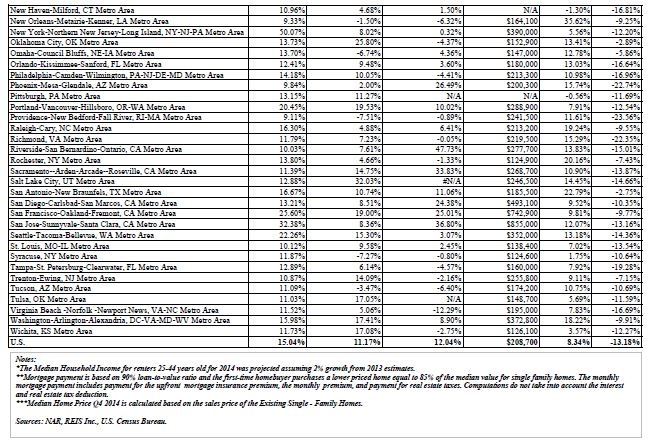

NAR’s research analyzed changes on income growth, housing costs and changes in the share of renter and owner-occupied households over the past five years in 70 metropolitan statistical areas across the U.S.

The top markets where renters have seen the highest increase in rents since 2009 are:

- New York, NY-NJ-PA,

- San Jose, CA,

- San Francisco, CA,

- Denver, CO,

- Seattle, WA.

A way to relieve housing costs is to increase the supply of new home construction – particularly to entry-level buyers. Builders have been hesitant since the recession to add supply because of rising construction costs, limited access to credit from local lenders and concerns about the re-emergence of younger buyers. It is estimated housing starts need to rise to 1.5 million, which is the historical average.