The Wall Street Journal

Condos around the country are getting a more critical eye. Prospective buyers are concerned about the possibility of higher bills because of major repairs and rising homeowners’ association dues. That piles on top of high prices and mortgage rates that are making homes of all types unaffordable.

Units are taking longer to sell than they did a year ago. Sellers are less likely to get their original asking price.

Sellers and their real-estate agents are finding that the most painless way to sell a condo is to be transparent about the state of the building’s finances. That might mean lowering the price to offset a current or future special assessment. It could also mean taking a lower price than identical units fetched just a few years ago.

Nationwide, the median price for a condo or co-op was about flat in April compared with a year earlier, lagging behind the 1.3% rise for single-family homes. Across the country, special assessments are helping to pay for unexpected or large expenses such as a new roof for the complex.

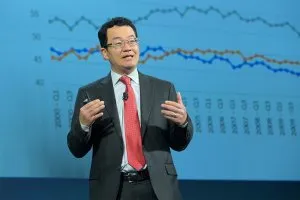

"It's firmly a buyer's market for condos," said Lawrence Yun, chief economist at the National Association of REALTORS®.