MarketWatch

Voters unhappy over soaring prices, including runaway housing costs, helped put Donald Trump back in the White House. But what will a second Trump presidency mean for the real-estate industry, and home buyers and sellers?

Because mortgage rates follow the direction of the yield on the 10-year Treasury, higher federal borrowing costs for the government’s debt in the future could in turn lead to higher mortgage rates for buyers, according to the Bipartisan Policy Center.

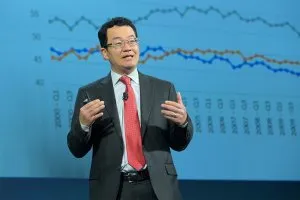

Therefore, expect Trump’s silence on the federal deficit to push up rates, Lawrence Yun, chief economist at the National Association of REALTORS®, told MarketWatch. “In the short term, mortgage rates will tick higher as the budget deficit outlook does not improve, even as the Fed is cutting its short-term interest rates.” Unless Trump’s actions lead to inflationary pressures subsiding, the Fed will not make deeper interest-rate cuts, which will keep mortgage rates high, Yun explained.