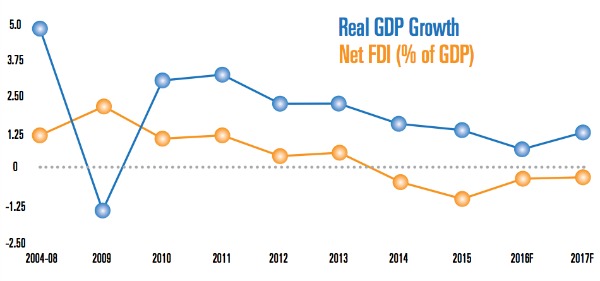

South Africa is the continent’s most mature, regulated and transparent real estate market. While it is generally viewed as the benchmark against which other African nations are measured, economic growth in South Africa has slowed and it still faces serious challenges, including poverty, unemployment and income inequality.

Residential Market

The trend towards urbanization is particularly strong in South Africa. By 2030, 70 percent of its population is expected to live in cities, exacerbating the current housing deficit and placing further pressure on demand for affordable housing for low- and middle-income families.

Among international buyers, the most attractive areas are Cape Town and the Western Cape, followed by Johannesburg.

Commercial Market

Retail developments have been the leading investment segment among South Africa’s property markets. The Mall of Africa is the most significant project, which opened last April and is located between Johannesburg and Pretoria. In general, local brands like Shoprite, Pick n Pay and Woolworths lead the retail segment, but overseas brands are appearing in increasing numbers (Zara, Forever 21, Topshop, H&M).

Interestingly, a growing number of investor/developer funds established in South Africa are targeting projects throughout the rest of SSA. For example, RMB Westport (an affiliate of Rand Merchant Bank) raised US$250 million for office and retail projects in Angola, Ghana and Nigeria.

Infrastructure

The government’s National Development Plan (NDP) places a high priority on resolving South Africa’s energy shortages, including a significant expansion in capacity and renewable energy sources. Roughly US$80 billion has been budgeted over three years for major infrastructure projects.