Imposing a 25 percent tariff on imports of steel and a 10 percent tariff on imports of aluminum, even if excludes those imports from Canada and Mexico, will raise the price of newly constructed home. The United States imported $47.83 billion of steel and aluminum commodities in 2017 on product types for which tariffs will be imposed, split between $29.1 billion for steel and $18.73 billion for aluminum. These import commodities accounted for only two percent of the $2.34 trillion in goods imported by the United States in 2017.[1] However, the effect will vary by commodity or industry. Because of the size of household spending on a home and motor vehicle purchase, the tariffs are expected to have the most impact on these expenditures. For most purchases, the price effect will be minimal.

Price Impact

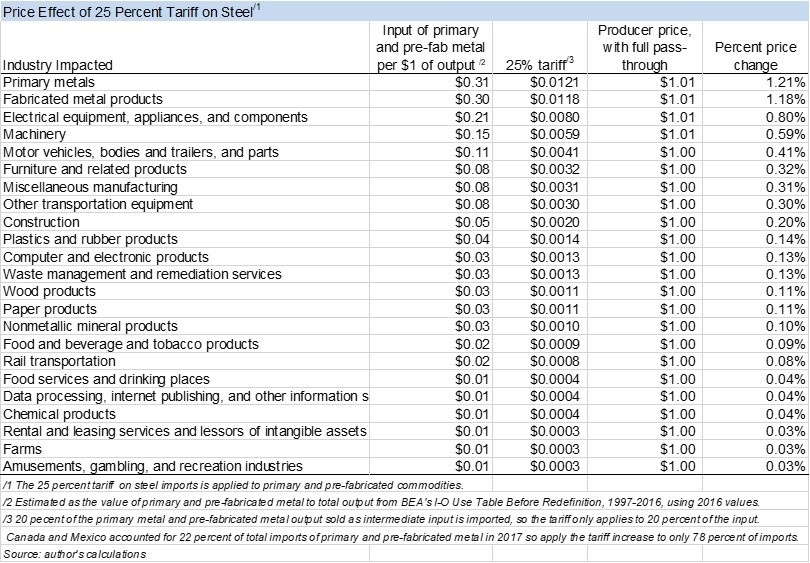

I used the 2016 71-industry input-output Use Table published by the Bureau of Economic Analysis to evaluate which industries are likely to be more impacted and to derive an estimate of the price effect.[2]. The list of 71 industries includes primary metals and pre-fabricated metals[3], an industry that encompasses steel and aluminum products. The Use Table does not separately identify residential and non-residential construction.

In the table above, the second column shows how much of primary metal and pre-fabricated metal is used to produce $1 of output of the industries listed in the first column, which are taken from BEA’s Use Table. Electrical equipment, appliances, and components are heavy users of primary and pre-fabricated metals, needing 21 cents per $1 of output. The production of motor vehicles and parts needs 11 cents of primary and pre-fabricated metal to produce $1 of output. The construction industry needs 5 cents of primary and pre-fabricated metal to produce $1 of output. Furniture and related products requires 8 cents per $1 of output.

I estimated the price effect by applying a 25 percent tariff on the primary and fabricated metal inputs using the following assumptions: 1) imports account for 20 percent of primary and pre-fabricated metal inputs[4]; 2) the tariff will affect 78 percent of primary and pre-fabricated metal imports because of the exclusion of Canada and Mexico[5], and 3) a full pass-through of higher tariffs to the buyer. Because a house and motor vehicles are the most expensive purchases, tariffs will have the most impact on these industries. In general, the price impacts are not large:

- Construction prices are estimated to increase by 0.2 percent. This means that a new home that cost $300,000 to build ix estimated to cost $614 more.

- Motor vehicles, bodies and trailers and parts are estimated to increase by 0.41 percent. This means that a car that previously cost $30,000 car is estimated to cost $124 more.

- The increase in cost for other items are not material because the size of the spending for these items is not as large. For example, electrical equipment, appliances, and component prices are estimated to increase by 0.8 percent, but a washing machine or refrigerator that initially cost $1,000 to produce is expected to cost $8 more.

Potential Impact on Exports

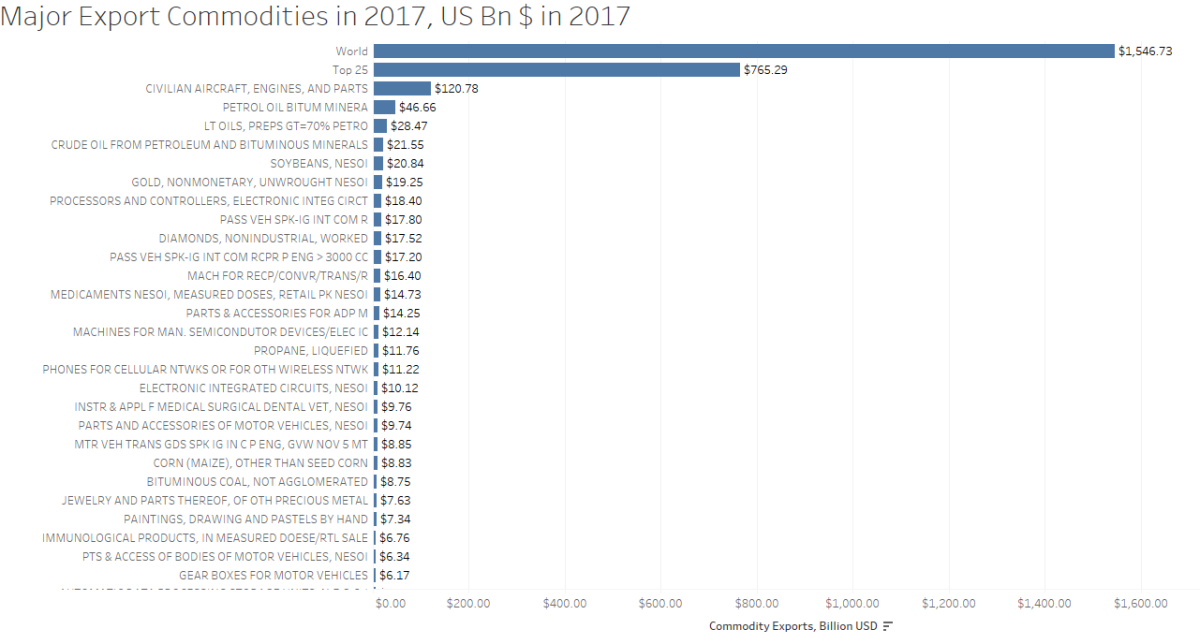

The tariff is intended to shift import spending to domestic spending and to spur employment, but the intended effect will be frustrated if other countries retaliate. The United States’ 10 largest export destinations (in 2017) were Canada, Mexico, China (and Hong Kong), Japan, the United Kingdom, Germany, South Korea, Netherlands, and Brazil. The U.S. major export commodities were civilian aircraft/ engines/parts, petroleum and other oil products, computer processors, and motor vehicles/parts. States exporting these commodities to these countries may be impacted in the event of significant retaliation. Thus far, the EU and China have signaled that they are not interested in a retaliation, but in resolving trade issues diplomatically.[6] In a Joint Statement released by the Department of Commerce on March 21, US Secretary of Commerce Wilbur Ross and European Commissioner for Trade Cecilia Malmström stated that they will launch “ a process of discussion on trade issues of common concern, including steel and aluminum, with a view to identifying mutually acceptable outcomes as rapidly as possible." The Chinese government, through China’s premier, Li Keqiang, has also said that the issue should be addressed through “dialogue and negotiation.”[7]

Use this data visualization to get state-level information on your state’s exports and trading partners.

[1]Steel and aluminum imports were calculated using data downloaded from USA Trade Online.

[2] Bureau of Economic Analysis Use Table Before Redefinition, at Producer Prices; https://www.bea.gov/industry/io_annual.htm

[3] Industry code 331 (primary metals) and 332 (pre-fabricated metals)

[4] Based on BEA’s 71-industry Use Table for 2016, imports of primary and pre-fabricated materials accounted for about 20 percent of output produced by the primary and pre-fabricated metal industry that is sold to industries (not final demand), and this general ratio is applied to all industries. The price impact will be higher (lower) if the share of imported primary and pre-fabricated metal used as an input is higher (lower) than 20 percent.

[5] In 2017, imports of primary and pre-fabricated metals from Canada and Mexico totaled $36.59 billion, or 22 percent of total imports from all countries f $161.9 billion.

[6] “EU Response to U.S tariffs will be responsible EU’s Tusk”, Reuters, reported on March 20, 2018, https://www.reuters.com/article/us-usa-trade-eu/eu-response-to-u-s-tariffs-will-be-responsible-eus-tusk-idUSKBN1GW28R

[7] “China vows to open its markets further in response to Trump’s tariff threats.”, Washington Post, https://www.washingtonpost.com/world/be-rational-not-emotional-china-tells-trump-as-trade-war-looms/2018/03/20/09cf3d9a-2bbc-11e8-8dc9-3b51e028b845_story.html?utm_term=.319787f4481c