The coronavirus pandemic has had a more acute impact on businesses providing accommodation services (hotels, motels, bed and breakfasts) compared to all industries broadly. Small businesses in the accommodation industry (NAICS 7211) continue to struggle financially due to decreased personnel and business travel and in-person business conferences or events. The latest Small Business Pulse Survey of the U.S. Census Bureau conducted during the week of December 12 demonstrates the continued adverse impacts of the pandemic (Download the December 2020 Commercial Market Insights Report):

- A higher fraction―63.9% of small businesses in the accommodation industry ― reported a decrease in operating revenue in the past month, compared to 38.9% of all respondents across the various industry sectors. Nationally, the percentage of respondents who reported decreased operating revenue has notably declined, but that has not been the case for the accommodation industry.

- With travel to recreation centers still below pre-pandemic level, 52.4% of small businesses in the accommodation industry need additional capital in the next six months compared to 27.9% among all businesses.

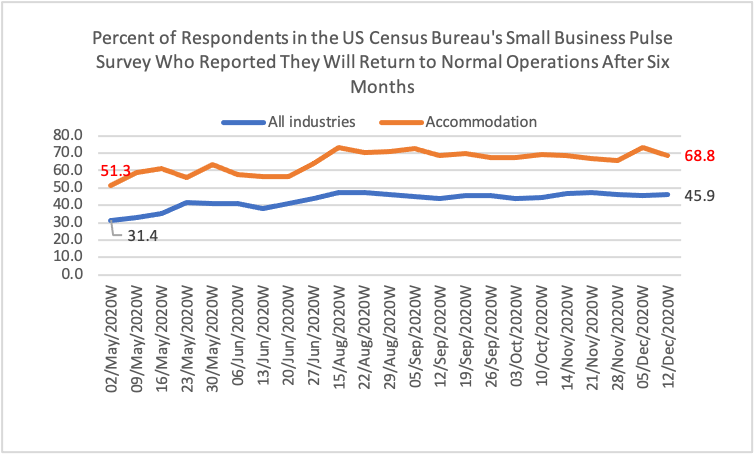

- A higher fraction―68.8% ― reported they will return to normal only after six months, compared to only 45.9% among all industries.

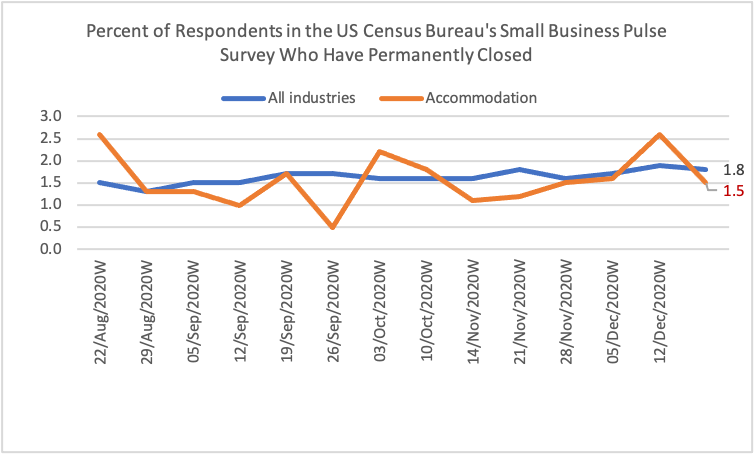

Less than 2% of Businesses Have Closed, 87% Obtained a PPP Loan

Despite the tremendous challenge that small businesses are facing, particularly businesses that provide accommodation services, less than 2% of all small businesses in the accommodations industry and all industries broadly have permanently closed, according to the latest US Census survey conducted during the week of December 12.

The Paycheck Protection Plan has helped prevent closings. A higher fraction of small businesses in the accommodation industry ―86.3% ― reported they obtained a Paycheck Protection Plan (PPP) loan compared to 72.7% among all respondents. The $284 billion of additional funding for the Paycheck Protection Program as part of the $900 billion COVID-19 Relief Package passed by Congress will help small businesses to meet their financial obligations so that they can re-open with higher capacity next year. The package allows for a second round of assistance, a simplified process for obtaining PPP Loan forgiveness, and deductibility of business expenses paid for with PPP funds. According to the US Small Business Pulse Survey, 69% of small businesses providing accommodation services expect to return to normal operations only after 6 months, compared to 46% of respondents in all industries.

99% of Businesses Have Less than 500 Employees, but Large Businesses Account for 60% of Employment

Financial assistance is essential to helping these small businesses survive that have closed through no fault of their own. Based on the 2017 Statistics of US Business, 99% of small firms in the accommodation industry have less than 500 employees and 84% of establishments have less than 500 employees. However, while most establishments are small businesses, the large hotels account for the bulk of the employees, accounting for 60% of total employment. To prevent massive unemployment, both big and small businesses require financial assistance. Such financial assistance is currently available under the PPP Loan Program (less than 500 employees) and the Main Street Lending Program that can help mid-size companies (seeking more than $2 million in financing and have at least $1 million in 2019 earnings before interest, taxes, and depreciation allowance).

Businesses providing accommodation services are located across the United States, but are concentrated in the big cities, led by Las Vegas, New York, Los Angeles, Orlando, Miami. Chicago, Washington DC, Dallas, San Diego, and San Francisco. These will also be the areas that will have the strongest recovery once personal and business travel resumes.