WASHINGTON (May 25, 2018) – Differences in household composition and financing options incentivize homebuying demand for veteran and active military, according to the 2018 Veterans & Active Military Home Buyers Profile, which evaluated the differences of recent active-service and veteran home buyers and sellers to those who have never served.

The results revealed quite a few contrasts between active-service military buyers and buyers who have never served. At a median age of 34 years old, the typical active-service buyer was a lot younger than non-military buyers (42 years old) and was more likely to be married and have multiple children living in their household. Active-service members typically bought a larger home that cost more than those purchased by both non-military buyers and veterans.

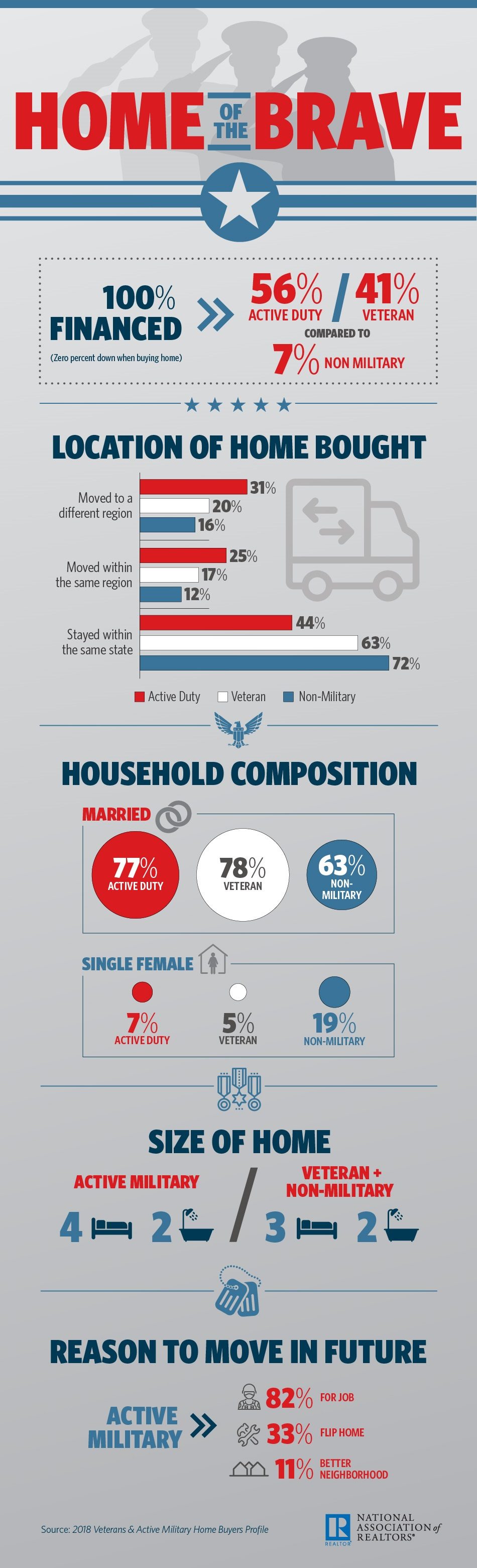

Despite lower median incomes ($84,000), more stable job security and no down-payment financing options give aspiring military homeowners an advantage over their civilian peers. Fifty-six percent of active duty and 41 percent of veterans put no money down when buying a home, compared to 7 percent of non-military.

Additional data from the report:

- Reason to move in future: 82 percent of active duty will move for their job, 33 percent to flip their home and 11 percent for a better neighborhood

- Household composition: 77 percent of active duty and 78 percent of veterans are married, compared to 63 percent of non-military

The National Association of Realtors® is America’s largest trade association, representing 1.3 million members involved in all aspects of the residential and commercial real estate industries.

Download (JPG 480 KB)

###