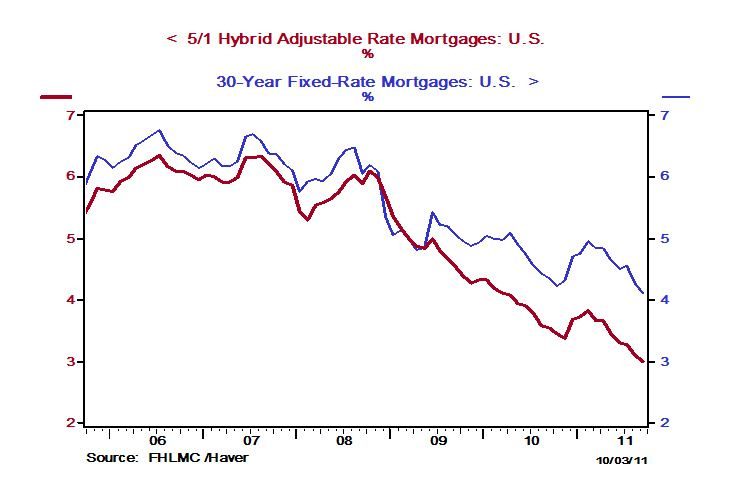

Interest rates have been falling across the board lately. It is due to the continuing ultra-loose monetary policy of the past three years and, more importantly, the very slow pace of economic recovery. The Federal Reserve had been buying long-term bonds with freshly printed money with the intent of lowering 10-year Treasury bond yields and 30-year mortgage rates. More recently, the Fed has been buying long-term bonds not with printed money but with money raised by selling short-term bonds (which had been purchased earlier and have been sitting in the Fed’s portfolio). This "Operation Twist", as it is commonly called, should bring down the longer-term interest rates at the cost of raising the shorter-term interest rates. More simply from a REALTOR®'s perspective, the Fed policy is an attempt to push down 30-year mortgage rates at the cost of pulling up rates on 1-year or 3-year or 5-year adjustable rate mortgages (ARMs).

Generally, short-term rates are lower because the risk of the interest rate changing after a few years on an ARM is borne by the consumers and not the lenders. Lenders charge a higher rate on 30-year loans because the consumer never faces interest rate risk during the 30 years of fixed monthly mortgage payments. But because of the new Fed policy measures, the interest rate spread between 30-year fixed conforming and ARM mortgages has slightly narrowed in the past month (Jumbo mortgage rates are unnecessarily high for another reason). It may mean that those consumers who have been contemplating a shorter-term mortgage rate should strike now rather than later.

But which consumers in their right mind would want to take out a short-term ARM when the 30-year fixed rates are already at rock bottom levels and are guaranteeing absolutely no changes in the monthly payment over the next 30 years come hell, high water, or high inflation?

Take the 5/1 Hybrid ARM as an example. The 5/1 Hybrid ARM offers a fixed mortgage payment for the first five years before readjustment occurs. The readjustment will be made based on a pre-set formula, such as LIBOR rate plus margin. Right now, the 5/1 Hybrid ARM is offered at 3% (and not 4% as is the case for 30-year fixed rate). After five years, it is conceivable for the ARM mortgage rate to rise to 5.5% and then rise further to 7% or 8% the following year. It is also possible for the readjustment to not occur at all or even fall after five years. We just don’t know. So which consumers would be willing to take this risk?

Anyone buying a home who knows with a reasonable certainty the he/she will move to another residence within 5 years is an ideal candidate for a 5/1 ARM. A medical doctor based in a rural town for a short stint, a parent buying a home for a college/grad student, and a family with a recently-born child not needing that extra room for a while are all natural candidates. Why pay a 4% rate when 3% is better? On a $300,000 mortgage, the monthly mortgage payment difference is $1,432 versus $1,265. Within 5 years, the consumer will have sold the home and used the proceeds to pay off the remaining mortgage balance while having pocketed $167 each month (A larger-sized mortgage yields larger monthly savings). Despite this potential benefit in ARM over 30-year fixed rate for certain individuals, less than 10 percent of consumers are taking ARMs.