NAR released a summary of existing-home sales data showing that housing market activity declined 4.3% this March from February 2024. March’s existing-home sales reached a 4.19 million seasonally adjusted annual rate, down 3.7% from March 2023.

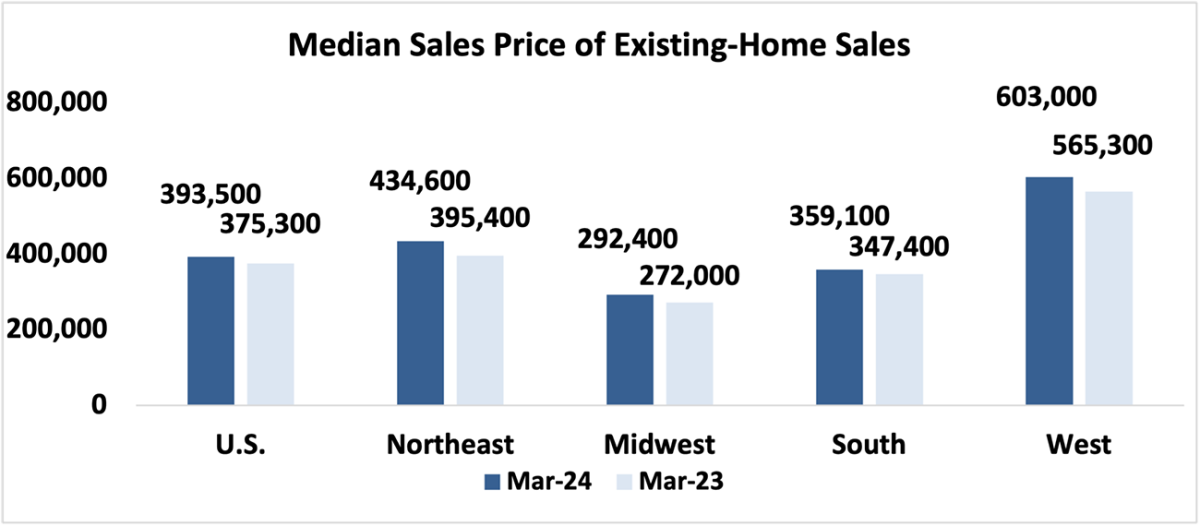

The national median existing-home price for all housing types reached $393,500 in March, up 4.8% from the same month a year earlier.

Regionally, in March, all four regions showed price growth from a year ago. The Northeast had the largest gain, 9.9%, followed by the Midwest, which increased by 7.5%. The West increased by 6.7%, while the South region rose by 3.4%.

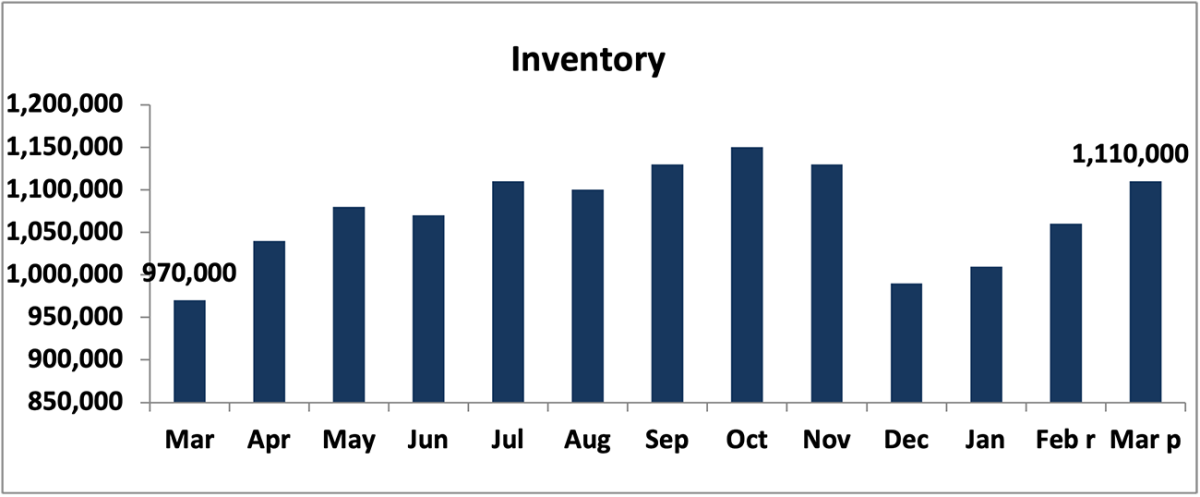

March’s inventory of unsold listings as of the end of the month was up 4.7% from last month, standing at 1,110,000 homes for sale. Compared with March of 2023, inventory levels were up 14.4%. It will take 3.2 months to move the current inventory level at the current sales pace, well below the desired pace of 6 months. Demand is currently outpacing inventory.

It takes approximately 33 days for a home to go from listing to a contract in the current housing market. A year ago, it took 29 days.

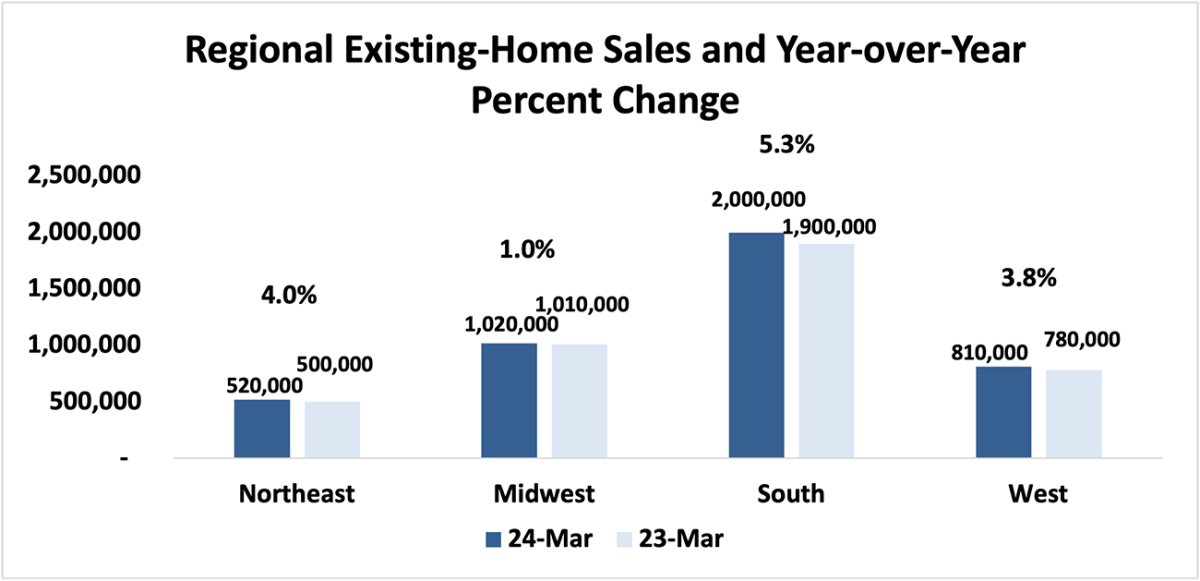

Sales in all four regions declined in March compared to a year ago. The South had the largest drop, 5.0%, followed by the Northeast, which fell 3.8%. The West dipped 3.7%, followed by the Midwest, which had the smallest decrease, 1.0%.

Compared to February 2024, one of the four regions showed an increase in sales. The Northeast region had the only increase of 4.2%. The West had the biggest decline, 8.2%, followed by the South, with a decrease of 5.9%. The Midwest region had the smallest drop in sales, 1.9%.

The South led all regions in percentage of national sales, accounting for 45.3% of the total, while the Northeast had the smallest share at 11.9%.

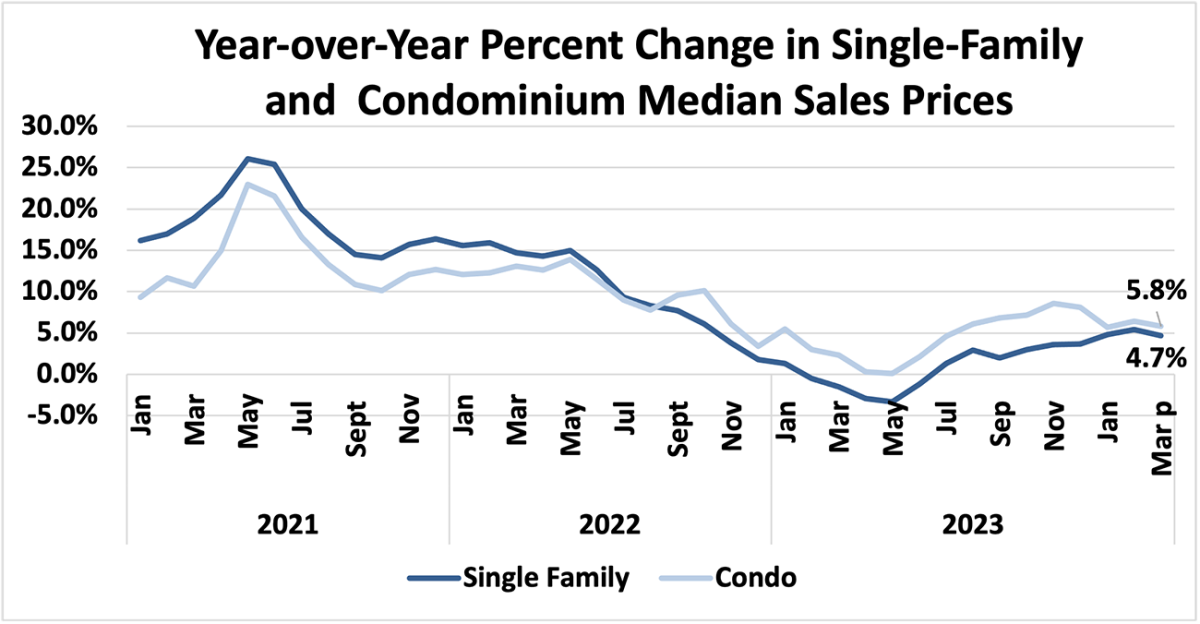

In March, single-family sales decreased 4.3%, and condominium sales were down 4.9% compared to last month. Compared to this time last year, single-family home sales were down 2.8%, while condominium sales fell 11.4%. The median sales price of single-family homes rose 4.7% to $397,200 from March 2023, while the median sales price of condominiums increased 5.8% to $337,900.