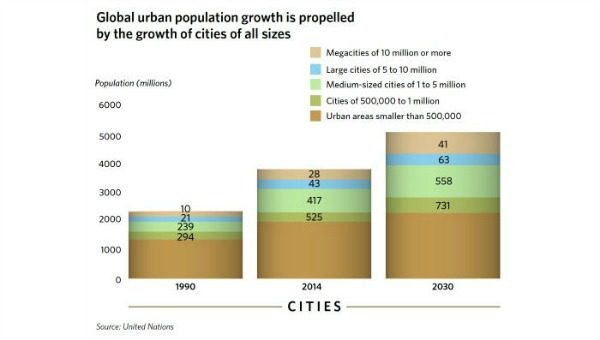

According to the United Nations, the world’s urban population is expected to increase by 380 million people by 2020. Pause for a moment and consider what 380 million more urban dwellers means. As Knight Frank points out, that’s the equivalent of building five cities the size of Los Angeles every year between now and 2020, plus all the supporting infrastructure.

That level of growth would trigger a huge demand for every type of urban real estate—and huge opportunities for global real estate agents. To capitalize on those opportunities, however, real estate practitioners need to stay in the know about the challenges facing global cities, including who is involved in addressing these challenges and specific development plans.

For elected officials and urban planners, success requires identifying the best investments over the long term (while also eliminating wasteful practices), then carefully planning each step in the process. It takes patience, tenacity, and long-range vision. It’s not unlike tackling a complex real estate development project. Your expertise in such endeavors may be a welcome addition to planning teams.

Cities with strong links to the global economy will have a distinct advantage over those that take a more insular view. Even secondtier players are becoming “global cities” by examining their unique competitive advantages, then implementing policies that attract additional global trade and investment. It’s a trend that proves, once again, that “global” is the place to be!

As urban planners, government policymakers, investors, and real estate developers work together to shape our future cities, what are some of their most important considerations? According to Hugh Kelly, a Clinical Professor of Real Estate at the NYU Schack Institute of Real Estate and 2014 Chair of the Board for the Counselors of Real Estate (CRE), they include:

As urban planners, government policymakers, investors, and real estate developers work together to shape our future cities, what are some of their most important considerations? According to Hugh Kelly, a Clinical Professor of Real Estate at the NYU Schack Institute of Real Estate and 2014 Chair of the Board for the Counselors of Real Estate (CRE), they include:

Cities vs. suburbs – Economic growth should not be a matter of urban centers prevailing over their suburban communities, or vice versa. As Kelly points out in his new book, 24-Hour Cities: Real Investment Performance, Not Just Promises, the most vibrant urban areas are those with a strong core and strong suburbs.

“It’s not a zero sum game,” says Kelly. “Incomes earned from high-paying jobs in the city are spent throughout the region.” In some cases, like San Francisco, the flow between home and work may be reversed. Adobe, for example, funds employees’ commuting costs to Palo Alto if they prefer living in downtown San Francisco, while Google runs its own shuttle buses.

Transportation – Cities must constantly reinvest in their transportation infrastructure—and the cost could spike dramatically as driverless cars enter the scene, potentially requiring a complete overhaul of our roadways (adding sensors, monitors, etc.) and introducing new density problems (parking spaces for more idle cars).

“While the technology is exciting, I don’t think the costs associated with autonomous cars have been fully penciled out,” says Kelly. “Like any large infrastructure project, this will take longer and cost much more than expected, especially in urban settings.”

Affordable housing – Living in global cities is generally an expensive proposition, with affordable housing being the tallest hurdle. Solving the problem is not just a question of creating inventory, but also a matter of creating better opportunities for inhabitants to move up the income ladder. Too often, entry-level jobs are dead-end jobs (think hotel employees, construction workers, or security personnel).

Real estate is one industry that could make a direct contribution. In fact, Kelly imagines that “the real estate industry could easily put together a program that took 100,000 people and put them on an upward track, by promoting real estate as a career instead of a job.” In addition to fostering a spirit of giving back to the community, such an endeavor could make a measurable difference in economic and income growth. It is also in the employers’ interests in a period where unemployment is already down to five percent, with labor markets likely to be tightening as the boomers retire.

Solutions aren’t simple, but fortunately the world is also filled with thought leaders and innovators, working across geographic borders to share actionable ideas and collaborate on successful results.